Operating Expenses: What is It, Calculation, Importance, Components

Rachael has a Bachelor’s degree in mass media from Wilson College, Mumbai and a Master’s degree in English from Pune University.

| updated July 16, 2024

What are Operating Expenses?

Copied Copy To Clipboard

Operating expenses (OPEX) are the costs required for the day-to-day functioning of a business. These expenses are essential for maintaining operations and include rent, utilities, payroll, and supplies.

Unlike capital expenditures, which are investments in long-term assets, operating expenses are recurring costs that do not directly generate future economic benefits but are crucial for sustaining business activities.

How to Calculate Operating Expenses?

Copied Copy To Clipboard

Operating expenses are typically calculated as follows:

Operating Expenses = Cost of Goods Sold (COGS) + Administrative Expenses + Selling Expenses

Why are Operating Expenses Important?

Copied Copy To Clipboard

Operating expenses are crucial for evaluating a company’s efficiency in managing costs and inventory. They reveal the expenditure required to generate revenue, which is a primary objective for any business. A company with higher operating expenses relative to its sales, compared to competitors, may be less efficient in generating those sales.

Effective management of operating expenses is critical for a company’s profitability. Lower operating expenses can lead to higher net income, assuming revenue remains constant. Companies often scrutinize these costs to identify areas where efficiency can be improved, thereby increasing overall profitability.

Key Components of Operating Expenses

Copied Copy To Clipboard

Rent and Utilities: Costs associated with leasing office space, warehouses, and other facilities, as well as expenses for electricity, water, and heating.

Payroll: Wages and salaries paid to employees, including benefits and payroll taxes.

Supplies and Maintenance: Costs of materials and services necessary to maintain daily operations.

Marketing and Advertising: Expenses incurred to promote the business and attract customers.

Insurance: Premiums paid for various insurance policies, such as liability, property, and health insurance.

How to Manage/Reduce Operating Expenses?

Copied Copy To Clipboard

Operating expenses are essential for the day-to-day functioning of any business. However, effectively managing and reducing these costs can provide a significant competitive advantage and boost profitability. Below are strategies businesses can employ to manage their operating expenses without compromising operational integrity and quality.

Importance of Balancing Cost Reduction

Management faces the challenge of cutting operating expenses while maintaining a firm’s competitive edge. While reducing costs can enhance earnings and provide an advantage, it is crucial to strike a balance to avoid compromising the quality and efficiency of operations.

Categorizing Expenses for Better Insights

An income statement provides a comprehensive overview of a company’s profitability by tracking income and expenses over a specific period. Expenses are typically categorized into six groups:

- Cost of Goods Sold (COGS)

- Selling, General, and Administrative (SG&A) Costs

- Depreciation and Amortization

- Other Operating Expenses

- Interest Expenses

- Income Taxes

When calculating operating income, interest expenses and income taxes are excluded.

Strategies to Manage Operating Costs

Automate Tedious Tasks: Implementing automation for repetitive tasks can significantly reduce labor costs and increase efficiency.

Advance Bill Payments: Paying bills in advance can help avoid late fees and penalties, thereby reducing unnecessary expenses.

Identify and Eliminate Waste: Regularly reviewing operations to identify and eliminate waste can lead to substantial cost savings.

Go Paperless: Transitioning to digital documentation reduces the need for paper, printing, and storage costs.

Negotiate with Vendors: Regularly negotiating with vendors can secure better deals and discounts, lowering procurement costs.

Use Expense Management Platforms: Implementing an expense management platform can streamline expense tracking and enhance savings through better oversight.

By adopting these strategies, businesses can effectively manage their operating expenses, improve efficiency, and maintain a strong competitive position in the market.

How to Find Operating Expenses?

Copied Copy To Clipboard

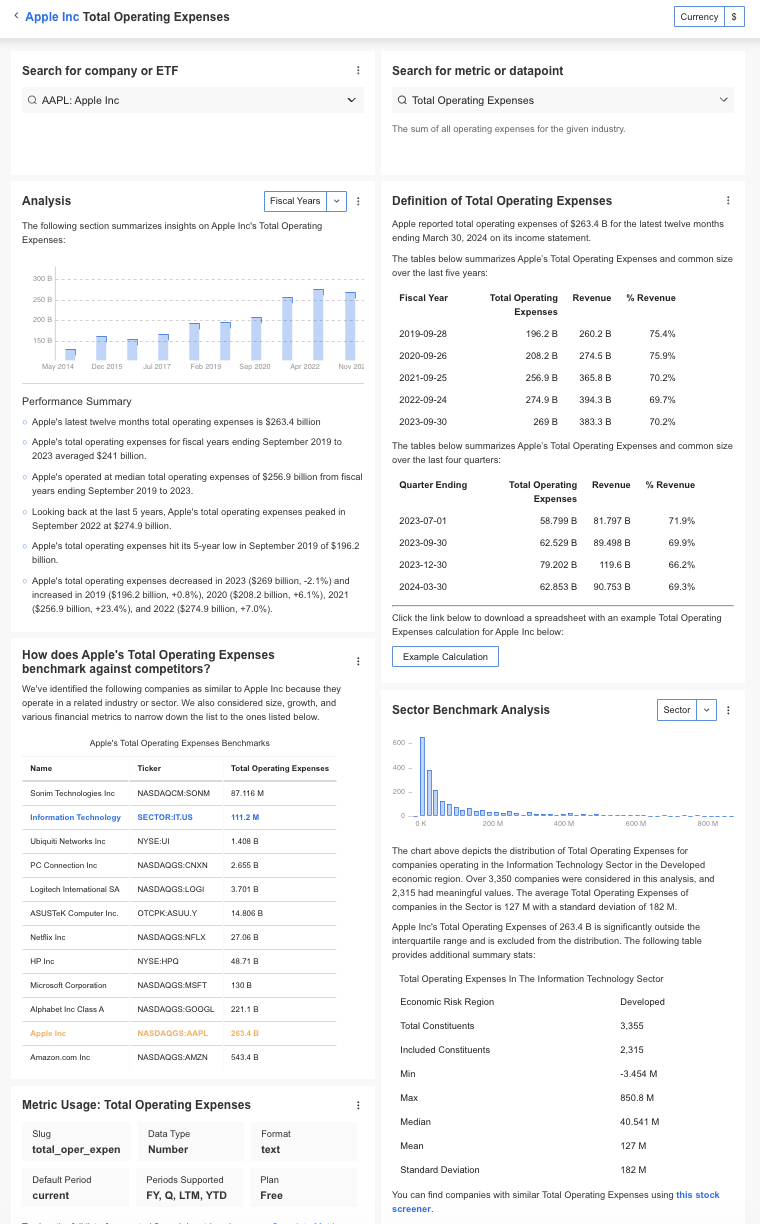

InvestingPro offers detailed insights into companies’ Operating Expenses including sector benchmarks and competitor analysis.

InvestingPro+: Access Operating Expenses Data Instantly

Gain instant access to operating expenses data within the InvestingPro+ platform

✓ Access to 1200+ additional fundamental metrics

✓ Competitor comparison tools

✓ Evaluate stocks with 14+ proven financial models

FAQ

Copied Copy To Clipboard

What is the difference between operating expenses and capital expenditures?

Operating expenses are recurring costs necessary for the daily operations of a business, while capital expenditures are investments in long-term assets that provide future economic benefits.

Why are operating expenses important to investors?

Operating expenses give investors insight into a company’s operational efficiency. By analyzing these expenses, investors can assess how well a company manages its resources to generate profit.

Can operating expenses affect a company’s stock price?

Yes, high operating expenses can reduce a company’s net income, potentially leading to a lower stock price. Conversely, efficient management of operating expenses can enhance profitability and positively impact stock performance.

How can companies reduce operating expenses?

Companies can reduce operating expenses by streamlining processes, renegotiating supplier contracts, implementing energy-saving measures, and optimizing labor costs through automation and improved workforce management.

Related Terms

- Levered Free Cash Flow (LFCF): Definition, Calculation, Importance & Interpretation

- Total Liabilities: Definition, Calculation, Types & Limitation

- Free Cash Flow Yield (FCF Yield): Definition, Calculation, Importance, Benefits & Limitations

- Fund Expense Ratio: Definition, Calculation, Importance & Components

- Repurchase of Shares: What it Is, Financial Impact & Limitations

- Deferred Compensation: Definition, Benefits, Importance & Limitations

- NOPAT (Net Operating Profit After Tax): Definition, Calculation, Importance & Limitations

- Cost of Revenue (CoR): Definition, Calculation, Importance & Limitations

- Unlevered Free Cash Flow: Definition, Calculation, Importance & Limitations

- Total Revenue: What Is It, Calculation, Key Features

- Diluted EPS: Definition, Calculation and Importance

- Interest Expense: Definition, Calculation, Key Takeaways & FAQs

- Equity Risk Premium (ERP): Definition, Calculation, Interpretation

- EBITA Margin: Definition, Calculation, Importance, & Limitations

- Real Estate Owned (REO): Definition, Value Assessment, Process & Limitations

- Net Debt: What Is It, Calculation, Interpretation

- Degree of Operating Leverage (DOL): What Is It, Calculation & Importance

- Cash Ratio: Definition, Calculation, Importance & Limitations

- EBITDA Margin: Definition, Calculation, Importance & Limitations

- Marginal Tax Rate: Definition, Calculation, How to Find

- Piotroski Score: Definition, Calculation, Importance & Limitations

- Receivables Turnover Ratio - Definition, Formula, Importance, Limitations

- Fixed Asset Turnover (FAT): Definition, Calculation, Importance & Limitations

- Book Value Per Share: Definition, Calculation, Importance & Limitations

- Operating Income Margin: Definition, Calculation, Importance & Limitations

- Prepaid Expenses: Definition, Importance, Limitations

- Days Sales Outstanding (DSO) - Definition, Calculation, Interpretation & Limitations

- Return on Invested Capital (ROIC): Definition, Calculation, Importance & Limitations

- Cost of Equity: Definition, Calculation, Importance

- Short-Term Investments: Definition, Types, Characteristics and Importance

- Effective Annual Interest Rate (EAR): Definition, Calculation, Limitations

- Return on Capital Employed (ROCE) - A Key Metric for Investors

- Financial Leverage: Definition, Calculation and Importance

- Asset Turnover: Definiton, Calculation, Uses

- Treasury Stock: Definition, Uses, Limitations

- Net Income: Definition, Calculation, Uses

- Cash Conversion Cycle: Definition, Formula, Uses

- Funds From Operations (FFO): Definition, Calculation

- Return on Assets (ROA): Definition, Calculation, Uses

- Net Working Capital: Definition, Formula, Uses

- Mortgage-Backed Securities (MBS): Definition, Uses

- Inventory Turnover Ratio: Definition, Calculation, Uses

- Effective Tax Rate: Definition, Calculation

- Common Stocks: Definition, Pros and Cons

- Accrued Expenses: Definition, Formula

- Operating Income: Definition, Formula, Uses

- Capital Expenditures: Definition, Calculation, Uses

- Accumulated Depreciation: Definition, Formula, Calculation

- Relative Strength Index (RSI): Calculation, Uses

- Return on Equity (ROE): Definition, Formula

- Understanding the Cost of Goods Sold (COGS) - Definition, Calculation

- Retained Earnings: Definition, Calculation

- Gross Profit and Gross Profit Margin - Definition, Calculations

- Current Ratio: Calculation and Uses

- Interest Coverage Ratio: Calculation, Uses

- Unveiling the Rule of 40: Calculation and Uses

- Quick Ratio: Definition, Formula, Uses

- EBITA: Definition, Calculation and Uses

- EBIT: Formula, Calculation and Uses

- Accounts Payable: Definition, Calculation

- Understanding Accounts Receivable: Definition, Calculation

- Understanding Beta: Definition, Calculation, Uses

- Understanding Revenue: Definition, Calculation

- EBITDA: Definition, Calculation Formulas, and Practical Applications

- Fair Value in Investing: Definition, Calculation and InvestingPro Instant Data

- Net Asset Value: Definition, Formula, Example

- Price to Sales Ratio: A Comprehensive Guide

- Debt to Equity Ratio Explained

- The Comprehensive Guide to Understanding the PEG Ratio

- Price to Book Ratio: Its Importance in Investment Decision-Making

- Free Cash Flow: What You Need to Know

- The Dividend Payout Ratio: What It Means and Reveals About a Company’s Growth

- Weighted Average Cost of Capital (WACC) Definition and Formula

- What Is MACD? - Moving Average Convergence/Divergence

- The Rule of 72

- Time Value of Money Explained: Formula, Examples, And More

- Volume Weighted Average Price (VWAP) Definition

- What Is Sharpe Ratio? Definition of Sharpe Ratio

- Compound Annual Growth Rate (CAGR) Definition

- Candlestick Patterns Explained

- Earnings Per Share (EPS) - Definition, Calculation, Formula

- Dividend Yield - Definition, Calculation, Formula

- Price-to-Earnings Ratio – P/E Ratio Definition, Formula and Examples

Recent Articles

Levered Free Cash Flow (LFCF): Definition, Calculation, Importance & Interpretation

What is Levered Free Cash Flow (LFCF)? Levered Free Cash Flow (LFCF) is a financial metric that measures the amount of cash a company has

Total Liabilities: Definition, Calculation, Types & Limitation

What Are Total Liabilities? Total liabilities refer to the combined debts and financial obligations a company owes to external parties. These liabilities can include loans,

Free Cash Flow Yield (FCF Yield): Definition, Calculation, Importance, Benefits & Limitations

What Is Free Cash Flow Yield? Free Cash Flow Yield (FCF Yield) is a financial metric that measures the relationship between a company’s free cash

Fund Expense Ratio: Definition, Calculation, Importance & Components

What is a Fund Expense Ratio? A fund expense ratio measures the cost of investing in a mutual fund, ETF, or other investment vehicles. It