Protected Cell Company" width="494" height="817" />

Protected Cell Company" width="494" height="817" />

A domestic company (DC) is domiciled and doing business in Mauritius.

Founding a DC is the cheapest way to register a company in Mauritius. A DC can be founded within 2-3 days.

Activities

A domestic company can be set up for various activities including Trading, Investment Holding, and Consulting Services amongst others. The activities can be conducted with residents as well as with non residents of Mauritius.

Registration

A domestic company has to be registered with the Registrar of Companies and governed under the Companies Act 2001.

License

A Trade Licence must be obtained from the Municipal Council / District Council pertaining to the location of its principal place of business.

Shareholders

The shareholders of a domestic company can be non resident of Mauritius. The minimum of shareholders is one.

Directors

At least one director must be appointed who is resident in Mauritius.

For proving that the Place of Effective Management (POEM) is in Mauritius and to avoid tax residency elsewhere, the number of directors being resident in Mauritius should exceed the number of international directors.

Our group can provide for resident directors if required.

Local presence

A virtual office might suffice depending on the nature of the business and the Municipal Council / District Council.

Accounting

Financial statements must be filed with the Registrar of Companies annually.

Audit

Auditing of the financial statements is not compulsory unless the turnover is at least Rs. 50 millions.

TaxationCorporate tax: 15%

The corporate tax rate is reduced to effectively 3% through a partial exemption of 80% of income resulting from foreign dividends, foreign interest, foreign permanent establishments, leasing of aircraft and ships, exported manufactured goods, and income of certain financial service providers (asset managers, CIS, Closed-end funds, CIS managers, CIS administrators).

Corporate Social Responsibility [CSR] tax: 2%, being applicable to chargeable income.

VAT registration of company is compulsory if turnover is exceeding Rs. 2 millions.

RestrictionsIf the DC conducts business predominantly outside of Mauritius and at least 50% of shares are held by non-citizens of Mauritius, the DC requires a Global Business License.

An Authorized Company (AC) is a new type of company according to § 71A of the Financial Services Act. It replaces the former GBC 2 company (non-resident company) which can no longer be founded in Mauritius.

Where the majority of shares or voting rights or the legal or beneficial interest in a company incorporated under the Companies Act are held or controlled, as the case may be, by a person who is not a citizen of Mauritius and such company –

(a) proposes to conduct or conducts business principally outside Mauritius or with such category of persons as may be specified in FSC Rules; and

(b) has its place of effective management outside Mauritius,

it shall apply to the Financial Services Commission for an authorisation.

Restricted activities

Except where otherwise specified in FSC Rules, an Authorised Company shall not conduct a business activity specified in the Fourth Schedule. (Banking, Financial services, Providing of registered office facilities, nominee services, directorship services, secretarial services or other services for corporations, Providing trusteeship services by way of business).

Shareholders

The shareholders of an authorized company can be non resident of Mauritius. The minimum of shareholders is one.

Directors

There is no need for having a director who is resident in Mauritius.

Effective management

is outside of Mauritius.

Registered agent

An Authorised Company shall, at all times, have a registered agent in Mauritius which shall be a management company.

Accounting

Financial statements must be filed annually by the registered agent.

Audit

Auditing of the financial statements is not compulsory.

TaxationCorporate tax: 15% on Mauritius sourced income only. (This is still to be confirmed by the FSC.)

The country where the Place of Effective Management (POEM) is may tax the income, depending on the tax law in this country and the provisons of a possible DTAA.

A Global Business Company (GBC) is the successor of the former GBC 1 company (resident company) which can no longer be founded in Mauritius. The main changes are in taxation and substance requirements.

Activities

Any activity, in or outside Mauritius.

Registration

A GBC has to be registered with the Registrar of Companies, is governed under the Companies Act 2001 and regulated by the Financial Services Commission (FSC).

License

A Global Business Licence must be applied for at the FSC.

Where an applicant for a Global Business Licence proposes to conduct any business for which a licence, authorisation, registration or approval is required under any relevant Act or other enactment, it shall apply for it before commencing business.

Capital

There are no minimum or maximum capital requirements and, except for the Mauritian Rupee, the share capital may be expressed in any currency.

Shareholders

The shareholders can be non resident of Mauritius. The minimum of shareholders is one.

Directors

At least two directors must be appointed who are resident in Mauritius. They must be of sufficient calibre to exercise independence of mind and judgement.

Our group can provide for resident directors if required.

Registered office

A GBC shall, at all times, have a registered office in Mauritius which shall be a management company.

Administration

A GBC shall, at all times, be administered by a management company.

Bank account

A GBC’s principal bank account shall be maintained in Mauritius at all times.

Bank accounts can be held in any convertible currency.

Effective management

Must be in Mauritius. Substance requirements include:

The assessment by the FSC will be made on a case by case basis. However, the FSC has released some indicative guidelines.

Accounting

Audited financial statements must be filed with the FSC annually.

Audit

Auditing of the financial statements is compulsory .

TaxationCorporate tax: 15%

The corporate tax rate is reduced to effectively 3% through a partial exemption of 80% of income resulting from foreign dividends, foreign interest, foreign permanent establishments, leasing of aircraft and ships, exported manufactured goods, and income of certain financial service providers (asset managers, CIS, Closed-end funds, CIS managers, CIS administrators).

VAT registration of company is compulsory if turnover is exceeding Rs. 6 millions, or if the company is engaged in businesses and professions specified by the laws (i.e., advisers including investment advisers and tax advisers, consultants including legal consultants, tax consultants, management consultants and management company).

Tax treaties

A GBC is resident in Mauritius for tax purposes and benefits from the advantages of the Double Taxation Avoidance Agreements which Mauritius has signed with 40+ countries.

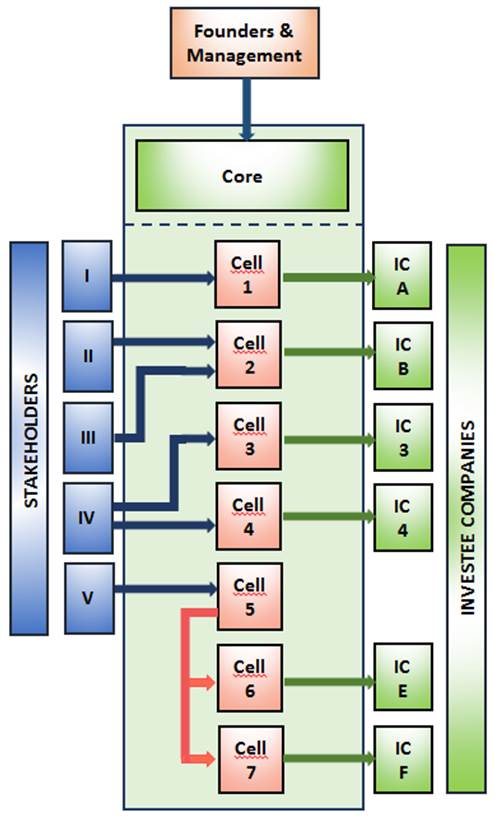

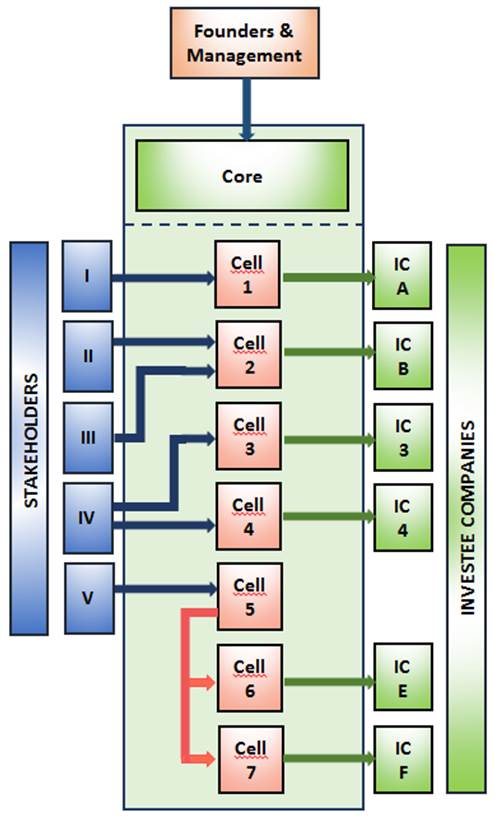

A Protected Cell Company (PCC) or (Segregated Portfolio Company (SPC) as it is known in jurisdictions such as Cayman Islands, Guernsey, Luxembourg and Bermuda) is a single legal entity within which may be established various cells. The assets and liabilities of each cell are legally separate from those of the other cells.

Protected Cell Company" width="494" height="817" />

Protected Cell Company" width="494" height="817" />

The PCC is a single legal entity and the cells are not independent legal entities separate from it.

A PCC operates in two distinct parts. These distinct parts are the Core and the Cells. There is (and must only be) one Core, but there may be an infinite number of Cells;

Cellular shares are issued, as required, under different names or numbers so as to identify, and to represent, the particular Cells to which they are attributable. Alternatively, each Cell may be given an identifying number, rather than a name.

Where assets have been allocated to a particular cell, those assets are held exclusively for the benefit of the owners of the particular cell and any counterparty to a transaction linked to this cell. Only persons who have entered into transactions with the cell, or who otherwise have become creditors of the cell concerned, will have recourse to that cell’s assets. Any asset which attaches to a particular cell is not available to meet liabilities of the PCC or any of the other cells.

Advantage of the PCC concept

The legal segregation of the assets and liabilities of each cell, particularly with respect to creditor recourse, enables the PCC to be used in many circumstances where previously a group structure of various companies may have been required. It is less expensive and less unwieldy than forming numerous subsidiary companies and it avoids the need for explicit limited recourse provisions in contracts with third parties and the issues associated with such provisions.

Range of applications

The PCC legislation represents a major opportunity for many international businesses. Prospective uses include “master-feeder”, umbrella or other mutual fund structures, providing for multiple classes of shares and multiple investment options, property development companies, asset holding, structured finance business, replacement for operating subsidiaries or divisions of any company, insurance business including captive insurance and re-insurance and facilitation of product line or geographic segmentation .

A PCC must have a Global Business License, with one exception: Real estate investments are also permitted in a PCC as a Domestic Company.